GST registration online for new user on GST Portal: Step by Step Guide

Goods and Services Tax or commonly known as GST is an indirect tax levied on the supply of goods and services in India. It’s a single tax on the supply of goods and services. In 2017, PM Shri Narendra Modi introduced GST in India with the slogan of One Nation One Tax. Goods and Services Tax helps to boost up the Economy of India and it has replaced other indirect taxes in India such as CST, service tax and VAT. As per the GST regime, GST registration is necessary for the business’s having a turnover of more than INR 40 lakh but in North East states GST is levied on the businesses having turnover of INR 20 lakh.

If

any business is found without registration under GST Act, then it will be deemed

as a punishable offence under the act and will have to pay heavy fine as

penalty. Registration under GST Act is compulsory for businesses like Dealers,

E-Commerce, Import and Export businesses.

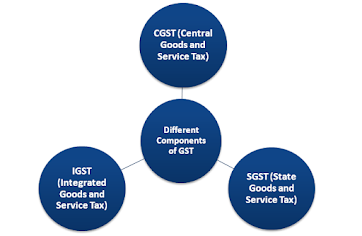

Different

Components of GST

There are 3 components of Goods and Services Tax which are mentioned-below:

Online GST Registration - Documents Required

The necessary documents required for the GST Registration depends on the type of business. The list of essential documents for all the business forms is mentioned-below.

For Proprietorship:

- Individuals should have Id Proof such as PAN Card or Aadhar Card, any address proof of proprietor.

- Address proof of office

- Copy of landline bill or water bill or electricity bill in case of own office and for rented office you have to submit rent agreement and NOC from the owner.

For Public Limited Company / Private Limited Company / One Person Company:

- Registration Certificate.

- PAN Card of the Company.

- Memorandum of Association/Articles of Association.

- Pan Card, Aadhar Card and a passport size of all the Directors.

- Bank Account Details such as bank statement or cancelled cheque.

- Address proof of Company.

- Copy of landline bill or water bill or electricity bill in case of own office and for rented office, you have to submit rent agreement and NOC from the owner

- Letter of Authorization.

For Society or Trust:

- Pan Card of Society or Trust.

- Registration Certificate and address proof of business.

- Photo and Pan Card of the partners.

- Bank Statement or cancelled cheque.

- Copy of landline bill or water bill or electricity bill in case of own office and for rented office you have to submit rent agreement and NOC from the owner.

- Letter of Authorization.

For Partnership:

- Aadhar card, PAN card and a photograph of all the partners.

- Bank details like cancelled cheque or bank statement.

- Copy of landline bill or water bill or electricity bill in case of own office and for rented office you have to submit rent agreement and NOC from the owner

- In

the case of LLP: Registration Certificate,

Letter of Authorization, and Copy of Board Resolution.

- Address proof of the place of business.

Online

Procedure for GST Registration

- Go to the official website for the registration i.e., https://www.gst.gov.in/.

- Click on the ‘Register Now’ button under the Taxpayers section.

- Then Select ‘New Registration’ and fill the New Registration Form.

- Then enter the OTP and the OTP will be sent to your registered email id and mobile number.

- Before click on the ‘Proceed’ button check all the details carefully that you have been entered.

- After this you will be shown the Temporary Reference Number (TNR) on your screen. Note the TRN for further process.

- After this, against visit the GST Portal and click on ‘Register’ button

- Select TRN and click on ‘Proceed’.

- Before proceed you will receive an OTP on email Id and registered mobile number. Enter the OTP and proceed.

- Then the status of the application will be available on the next page.

- Visit the ‘Verification’ page and check the declaration. Then use one the methods mention below to submit the application.

- By Electronic Verification Code (EVC)

- By e-Sign method

- In case of companies are registering, use Digital Signature Certificate (DSC) to submit the form.

- Once the application process completed, the Application Reference Number (ARN) will be sent to the registered mobile number.

- You can also check the status regularly on the GST portal.

Conclusion

The

evolution of GST will bring the corruption-free tax,

removing the shortcomings in indirect tax structure an helps to boost the country’s

economy because it is consume as well as business-friendly. GST registration is

necessary for business’s having a turnover of more than INR 40 lakh but in

North-East states GST is levied on the businesses having turnover of INR 20

lakh.

Set a foot in the Nepal telecom and radio market by obtaining NTA Type Approval with India's #1 compliance service provider. Get your NTA Certification or NTA Approval for Nepal now from best consultant.

ReplyDelete