How can I register an LLP company in India?

LLP stands for Limited Liability Partnership, has a separate legal entity from its partners, and has perceptual succession. The business structure of a Limited Liability Partnership is easy with the benefits of limited liability. LLP Registration gives all the partners the freedom to form a partnership structure where each partners' liabilities are limited. It offers extra benefits in comparison to the partnership firm. In LLP, an agreement between the partners decides the duties and mutual rights of the partners. It can take any contracts and hold property in its name. Scroll down to check more information regarding the process of LLP Registration in India.

What are the advantages of LLP Registration?

Following are some advantages of LLP Registration that you can avail yourself after the completion of the registration process:

- Low Cost of Registration

The registration cost of LLP is very low compared to any other company like Public Limited or Private Limited Company.

- No requirement of Audit

In other companies, it is compulsory to get their accounts audited, but in the case of LLPs, there is no requirement to audit the accounts. LLP is required to audit their account in two situations when the contributions exceed Rs. 25 Lakhs or when the LLP turnover exceeds Rs. 40 Lakhs.

- No requirement of Minimum capital

There is no such capital requirement specified under the LLP. In the case of a Pvt. Limited Company and Public Limited Company, the capital requirement is Rs. 1 Lakh and Rs. 5 Lakh, respectively.

- No limit on partners/owners of business

In LLP, a minimum of two partners/owners are required, and there is no such limit on the maximum number of partners/owners. LLP helps to protect the partnership name from any other company or partnership registering the same name.

What are the essential documents required for LLP Registration?

Following are some essential documents required at the time of LLP Registration:

Documents of Partners:

- All the partners must submit their PAN card as a primary identity proof for LLP registration.

- Submit the address proof of partners; Voter ID, Aadhar Card, Driving license, or passport. The name and other details in the documents should be the same, as mentioned in the PAN card.

- Submit residence proof of all the partners such as latest electricity bill, mobile bill, water bill, bank statement, etc. All the residential proof documents must contain the partner's name, as mentioned in the PAN card.

- Passport for NRIs and Foreign nationals: At the time of registration, it is mandatory to bring a copy of their passport. The passport should be notarized by the authorities or the Indian embassy situated in the respective country. NRIs or Foreign Nationals must submit an address proof, which can be a bank statement, driving license, or any identity proof issued by any government containing the address.

- Submit the latest passport size photographs of all the partners.

Documents of LLP:

- Digital Signature Certificate

The limited liability partnership firm's designated partners must provide DSC to sign all the forms digitally.

- Address proof of the registered office

An applicant of the firm must submit the address proof of the registered office within 30 days of registration. If the registered office is on rent, you have to provide a rent agreement and the NOC. For the residential proof, an applicant can submit the latest telephone bill, water bill, electricity, or gas bill.

What is the procedure of LLP Registration in India?

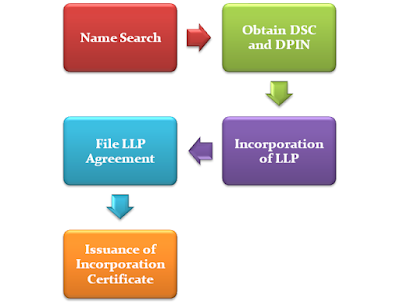

Following are the steps to complete the LLP Registration process in India:

Step1: Name Search or Reservation of Name

Fill and submit the SPICe+ form by the designated partner or owner to check the LLP name's availability. The name of the LLP must be unique and identical, and it is recommended to use the MCA portal for a free name search facility. The company's name should not match with other companies who already registered in the past.

Step 2: Obtain DSC

After the name approval, obtain the DSC (Digital Signature Certificate) for the firm's designated partner. DSC is very obtainable because LLP registration is online, and all the necessary documents are to be signed digitally.

Step 3: Obtain DPIN

Obtain a Designated Partner Identification Number (DPIN) for all the partners of the firm. To obtain DPIN, you have to file DIR-3, and the applicant has to attach a scanned copy of the PAN and Author card along with the form.

Step 4: Filing Incorporation of LLP

Then, you have to file the incorporation form, i.e., FiLLip (Form for Incorporation of a Limited Liability Partnership), by mentioning all the designated partners' details. Applicants have to pay a particular fee as per "Annexure A."

Step 5: File LLP Agreement

File LLP agreement in form 3 online on the MCA portal, and it has to be filed before the 30 days of the date of incorporation.

Fees for LLP Registration in India

The LLP registration fees in India vary from state to state, and also, the whole registration process from obtaining DSC to LLP agreement takes around 15 days.

Below-mentioned is the estimated fees of different governments’ forms:

|

Government

Forms |

Fees |

|

For DSC (Digital Signature Certificate) |

Rs. 1500/- to Rs. 2000/- (it depends upon the

agency) |

|

For DPIN (Designated Partner Identification

Number) |

Rs. 1000/- |

|

For the Reservation of Name |

Rs. 200/- |

|

LLP Incorporation |

Rs. 500/- (For the contribution up to Rs. 1

Lakh) Rs. 2000/- (for the contribution between Rs.

1 Lakh and 5 Lakhs) |

|

LLP Agreement |

As per the capital contribution and stamp

duty charges of a different state. |

Conclusion

Most of the companies are getting converted from Private or Public to LLPs. LLP registration is very beneficial to all small and medium business enterprises because it provides various tax benefits. It enables entrepreneurs to focus on the core activities of the business. The business structure of LLP is easy with the benefits of limited liability.

Click here and get your ANRT approval, ANRT Certification, ANRT Certification Morocco, ANRT approval Morocco, Morocco approval, ANRT type approval, ANRT Morocco approval, Morocco global approval ANRT Approval or ANRT Certification for Morocco now from best consultant. Get in touch with India's leading compliance service provider and enter the Morocco market seamlessly with ANRT Certification

ReplyDelete