How to get One Person Company Registration?

One

Person Company registration is a forward-thinking concept which

promotes the Incorporation of micro-businesses with persons having

entrepreneurial dreams but has limited time, resources or means to execute the

business plan. It is the combination of Sole proprietorship and the standard company, where the OPC would enjoy the best of two worlds.

What is one person company?

Under

Section 2(62) of Companies Act, OPC

is defined as a company operated by an individual who is both a shareholder as

well as a director at the same time.

The

OPC is appropriate for a small business which has an average turnover of Rs. 2

Crores and the maximum amount of capital are limited to Rs. 50 Lac. An OPC can

have more than one director and must be an Indian Resident.

Who is allowed to go for One Person Company Registration?

Only

Indian residents are allowed to register One Person Company. Besides, only

one entity is allowed to be set up by the Ministry of Corporate Affairs.

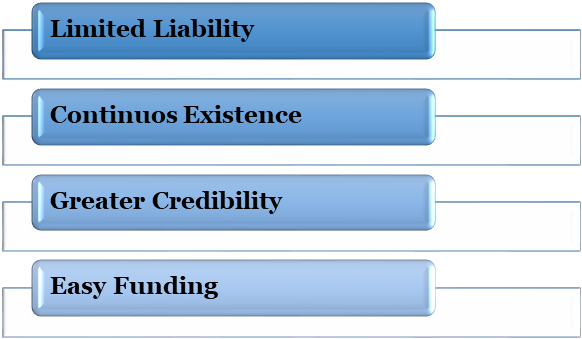

Advantages of One Person Company Registration

·

Limited liability

The

director's personal property is always safe, no matter the debts of the

business.

·

Continuous existence

OPC

has a separate legal identity. In case of death of the owner, the Company would

pass on to the nominee director.

·

Greater credibility

OPC

is more trusted among vendors and lending institutions.

·

Easy funding

It is easy for OPC to raise funds using venture capital.

What is the Eligibility Criterion?

The

eligibility criteria are:

- Citizen of India;

- Can incorporate one-person

Company;

- Can be a nominee for the

member of the Company

- Should be staying in India

for at least 182 days from the previous year.

- If the turnover exceeds Rs

2 crores, OPC has to be turned into a Private Limited Company within six months.

Documents required for One Person Company Registration

Documents to be given by the

director

- Scanned copy of PAN;

- Scanned copy of Voter ID

or Driver's License;

- Scanned copy of Current

Bank Account Statement or Mobile Invoice or Electricity bill;

- Scanned passport-sized

photo.

Documents necessary for the

registered office

- Proof of registered

address;

- Copy of rent

agreement;

- No objection certificate

from the landowner of concerned property;

- Copy of sale deed

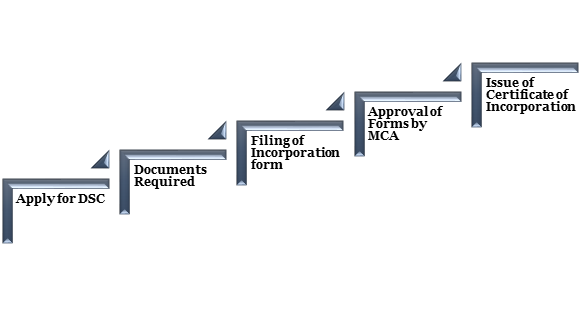

Process of One Person Company Registration

Fill

the SPICe+ form:

The

First Step to obtain the Digital Signature Certificate of the director is to fill up the SPICe + form, which requires the following details:

- Address Proof

- Aadhaar card

- PAN

- Photo

- Email Id

- Contact Number

Documents

Required:

We

have to prepare the following documents which are required to be submitted to

the Registrar of Company:

- The Memorandum of

Association (MoA)

- The Articles of the Association (AoA)

- There is only 1 Director

and a member so it is necessary to appoint a nominee because of the owner

dies and cannot perform his duties, the nominee will act on behalf of the

director and take his place.

- Proof of the Registered

Office along with the evidence of ownership and a NOC from the owner.

- A declaration that all

compliances have been followed.

Filing

of Incorporation form:

The

incorporation form has to be filed along with the documents mentioned above.

Approval

of forms by MCA:

Ministry

of corporate affairs will verify the forms submitted and approve the forms

after verification.

Issue

of Certificate of Incorporation:

The

Registrar of Companies (ROC) will issue a Certificate of Incorporation.

What

are the Post One Person Company registration compliances?

Every

One Person Company must follow the necessary compliances:

- Board meetings have to be

held in every six months. The time gap should not be less than 90 days;

- Book of accounts has to be

adequately maintained;

- Statutory audit by Charted

Accountant

- Income tax returns have to

be file every 30th September.

Can One

Person Company (OPC) raise investment?

One Person Company (OPC) is

a newly added concept that came into effect with the

introduction of Companies Act 2013. This is the only legal structure that allows sole-person to start his Company with several

concessions and rebates provided under the law.

OPC being a single-member the company, cannot raise investment through the issue of shares as 100%

shareholding of OPC shall remain with single-member. Although, unlike other private limited companies, it is

allowed to raise funds through the issue of

debentures and loans.

Apart from several benefits

and ease of running OPC, the law imposes several restrictions upon it, such as

OPC is not allowed to raise capital through investment. We have discussed other

such limits imposed on OPC along with its registration criteria henceforth.

What are

the ways for conversion of OPC?

Conversion of OPC into Private

Limited is governed under the Companies Act 2013.

Converting the OPC will not affect its existing debt, liabilities, obligations

or contracts. OPC can be converted into private limited in two following ways:

●

Voluntary:

Voluntary conversion is when the owner, upon its discretion, willing to transform

itself into private limited. He is not permitted to do so unless two years are

expired from the incorporation date. Under voluntary conversion, OPC shall

notify the registrar by filing INC-5 within 60 days of such transformation.

●

Mandatory:

Mandatory conversion is when OPC shall convert itself into private limited

compulsorily in the following situations:

·

Paid-up share capital exceeds INR 50

Lakhs; or

·

Average turnover of the preceding three

years exceeds INR 2 Crore

What are

the Annual Compliances of OPC?

Annual compliances of OPC are similar

to that of private limited with slight changes in such requirements. We have

enumerated the list of yearly agreement of OPC henceforth:

●

OPC shall mandatorily conduct at least

one board meeting every six months. That is minimum two board meeting shall be attended

yearly with a gap between two meetings being 90 days or more

●

Director of OPC in first Board Meeting

of the financial year shall disclose his interest in other entities through

form MBP-1

●

Director shall file a declaration of

his non-disqualification with the Company every year through form DIR-8

●

However, OPC needs not to conduct AGM

but is required to register financial statements through the filing of AOC-4 to

ROC

●

It shall also file an annual return in

form MGT-7 within 60 days of recording the entry of ordinary resolution in its

minute books

Conclusion

One

Person Company is a kind of Company that can be incorporated with just one member.

This makes a One Person Company is a type of business entity which is best for

individuals who want to start a business alone. With Corpbiz,

you can easily have your own One Person Company Registration in India.

Comments

Post a Comment