How to obtain 80G Registration?

|

Procuring an

80G registration for your non-profit organization can grant the donors a chance

to avail tax deductions on donations. Additionally, obtaining 80G Certificate

can also help increase the total count of donations your non- profit

organization collect. This article all about 80G Registration and the

advantages of holding an 80G Certificate.

What is 80G Registration?

Procuring an 80G registration for your non-profit organization can grant the donors a chance to avail tax deductions on donations. Additionally, obtaining 80G Certificate can also help increase the total count of donations your non- profit organization collect. This article all about 80G Registration and the advantages of holding an 80G Certificate.

What is 80G Registration?

80G

Registration or 80G Certificate is a certificate that allows the people making

donations in your organization to avail tax deductions under Section 80G of

Income Tax Act, 1961. Furthermore, religious charities or angel businesses are

not generally issued an 80G Certificate. Moreover, gifts made to or trusts that

are operating outside India or foreign trusts are not eligible for tax

deductions.

Benefits of 80G Registration

Getting 80G registration has many advantages which are

discussed below in detail;

- Attract more donors: Obtaining 80G registration attract more donors as they get tax deductions under Section 80G of the Income Tax Act

- Tax benefits: Also, you are provided with various tax benefits when your institution is registered under Section 80G

- More access to funding: Furthermore, the chances for your trust to raise funds increases when you hold 80G registration

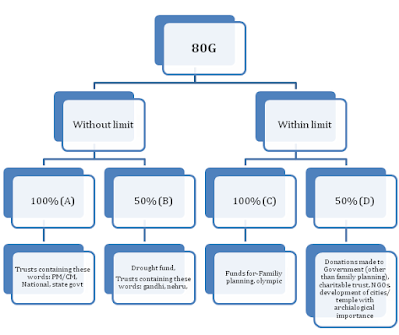

Deduction percentage under Section 80G

Deductions

are provided to the taxpayers in some percentage as prescribed by relevant

law.

- Donations made to Prime minister relief fund is eligible for 100% deduction under section 80G without any upper limit

- Payments made to trusts like “Indira Gandhi memorial trust” is suitable for 50% deduction without any specified limit

- An approved institution, i.e. institutions encouraging and promoting family planning is eligible for 100% exemption under section 80G

- Any charitable trust that is included in the list is suitable for 50% deduction under section 80G

Documents required to claim deductions under Section 80G

The

documents required to register under Section 80G of the Income Tax Act are as

follows;

·

A

copy of PAN Card (NGO)

·

Duly

filled Form 10G

·

Trust

Deed / MOU

·

Summary

of welfare activities carried in the preceding 3 years

·

Balance sheet and

books of accounts of the previous 3 years

·

List of donors

along with their address and PAN

·

List of the

governing board of trustee’s members with their contact details

·

Original

Registration Certificate

For Proposed Registered office

(Residential or commercial)

·

Any Utility bills

·

Scan copy of Rent

agreement with NOC from owner

Mode of payment eligible for a tax deduction

Not all form

of payment is qualified for claiming tax deductions under Section 80G.

Furthermore, only a specified method of payment is allowed for the deductions

which are as follows;

- Donations made in the form of gifts do not qualify for tax benefits

- Also, the donations made in kind will not help you with tax benefits during a disaster such as floods, earthquake

- Contributions deducted from salary can be claimed by providing the receipt received at the time of payment

- Only donations made in cash or cheque qualifies for a tax deduction

Necessary Compliance requirements for 80G registration

The applicant

of the 80G registration must comply with the following conditions;

- An

application can only be made by registered societies, public charitable

trusts, recognized educational institution or any institution funded by

the Government

- The

institution or trust applying for the certificate must be duly registered

under the Societies Registration Act, 1860, Section 25 of the Companies

Act or under any other relevant laws.

- Applicants

of the certificate must not correspond to any religion-based or caste and

creeds based activity.

- The

donated funds received by these trust/ institution should only be used for

charitable purposes

- The

registered trust should not hold any income which is not exempted

- Institutions

pursuing any other businesses side- by- side are required to maintain a

separate book of accounts so that the received donations are not confused

with savings of any other kind

- The

applicant should manage an appropriate record of annual returns, accounting

and bookkeeping before applying for the certificate.

- Finally, the recipient of the certificate must make sure that they renew their certificate regularly.

Procedure for 80G registration

You need to follow the following steps to obtain 80G Registration for your trust/

institution;

- You need to submit the application to the Commissioner of Income Tax along with necessary documents

- Then, the Income Tax officials conduct an On-premise inspection after successful submission of application and documents,

- Furthermore, the department officials may ask for additional

documents or evidence if they feel the need

- Finally, after successful verification of the premise and the documents, the 80G Certificate is granted to the institution

Issuance of 80G Certificate

After

receiving the application, the Commissioner passes a written order upon

successful verification of the application which would effectively register the

trust under Section 80G of the Income-tax Act.

Additionally,

the Commissioner may ask for further documents from the applicant if the need

for the same is felt, or reject the application in the worst case. Moreover, the

registration accorded to the trust is legitimate for a period of one-three

years.

Conclusion

Obtaining

80G registrations is supportive to you in many ways; i.e. it helps attract more

donors, grows trust and helps raise fundings from the Government. Also, it aids

the people who make donations to your trust to avail some or all part of the

donation made. Basically, it is a win-win situation. Corpbiz

Thanks for Share Valuable Information.........BIS has 5 provincial authorities and 19 branch agencies. The provincial agency directs the comparing branch department. BIS India Registration research centers and some autonomous labs are liable for the examination of tests taken during the item affirmation measure.

ReplyDelete